Recent Blog Posts

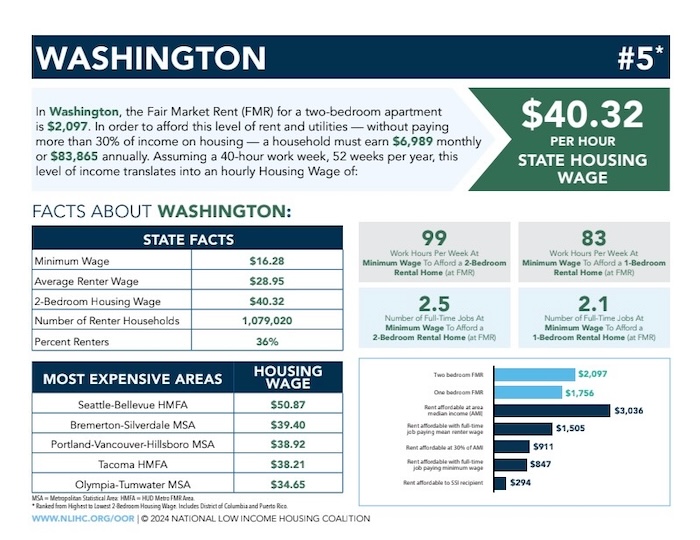

For the second year in a row, Washington was ranked with the fifth-highest hourly “housing wage” in the country. The state average “fair market rent” for a 2 bedroom is $2,097, meaning, in order to afford rent and utilities without paying more than 30% of one’s income for housing, one would need to earn $6,989 monthly.

The National Low Income Housing Coalition’s annual Out of Reach report exposes the gulf between wages and what people would need to earn to afford their rents. The report’s “housing wage” is an estimate of the hourly wage full-time workers must earn to afford a rental home at fair market rent without spending more than 30% of their incomes. Washington’s mean renter wage was only $28.95 an hour. To afford a modest, two-bedroom apartment at fair market rent in Washington, full-time workers need to make $40.32 per hour ($33.77 per hour for a one bedroom). Workers would need to be making $50.87 an hour to afford a two bedroom home in the Seattle/Bellevue area. Working at the state minimum wage of $16.28, renters would need to work 83 hours a week to afford a 1-bedroom rental home or 99 hours a week to afford a 2-bedroom rental home.

Sharon Pevey, a retired nurse who must pay rent where she owns a manufactured home in Vancouver shared, “When I moved in my rent was $525 monthly, now four years later I pay $1,200, and that no longer includes water and sewer. The sky's the limit for landlords in Washington.They are given tax breaks, given land to develop, but if you are a renter, you live in fear of the next increase and homelessness. I run my business in Portland and at age 76, will always need to work to face the unknown. We deserve stability and predictability, but seniors like me are living in fear of the next price increase that will land us on the street.”

Brianna Vazquez, a single mother who has had to move five times since coming to Washington state in 2018 and now lives in Kent, shared: “I’m not low income, but rent increases have become untenable for me. I was paying $2,049 and received a notice from the landlord of a 15% rent increase. Without a limit on how much landlords can hike rent, I expect to be forced to move again.”

With regard to real estate sites and media reports that rent in some regions may have declined recently, housing cost experts say over year data doesn’t provide a comprehensive picture. Indeed, these real estate sites have declared many times that rent increases are cooling down, only for them to go back up. Data availability lag times, market fluctuations and many other factors can influence a point in time snapshot. But over the past five years, the “housing wage” necessary to afford rent for a 1-bedroom home has increased 51% statewide, and by 45% for a 2-bedroom home since 2019.

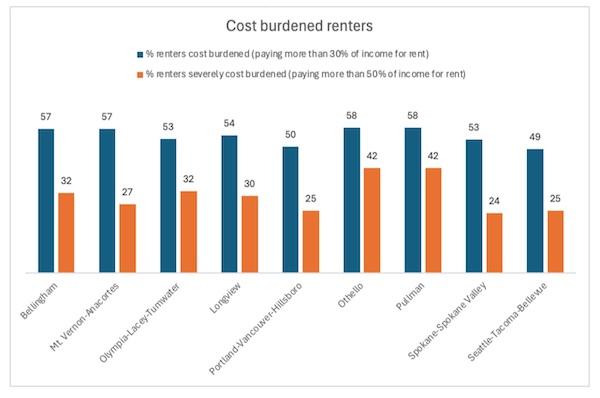

The Joint Center for Housing Studies at Harvard University found a large number of cities across Washington where large percentages of renters were “cost burdened” or “severely cost burdened.”

Michele Thomas, director of policy and advocacy for the Washington Low Income Housing Alliance, reacted to the report’s findings: “Short term fluctuations in rent and availability of units don’t reflect the fact that rents across the state have skyrocketed over the last decade, displacing tens of thousands of renters and significantly contributing to homelessness. A failure to enact legislation to stabilize renter households has meant no relief for more than 1 million renters across the state, and rent gouging continues.”

Ed King of Bellingham shared: “Before I became disabled due to complications from MS, I was a small business owner. In 2022, I found myself in a position I had never imagined, having to live out of my car. I was displaced from my longtime home due to an extreme rent increase. I was on the affordable housing waiting list for 8 years. When landlords can raise the rent as much as they want and there’s nowhere to go, what’s the option? I want Washington to be a state where people and families can thrive, where stability is not a luxury, but a fundamental right.”

Tina Hammond from Spokane is a retired senior living with a disability: “Since 2019, the rent on the lot I occupy with my manufactured home has increased multiple times. I was sorely impacted by the 12% increase I experienced earlier this year.”

Existing research shows a strong connection between rents and homelessness in the U.S. Nationally, the annual Point-In-Time count conducted by the U.S. Department of Housing and Urban Development found that approximately 653,000 people were experiencing homelessness in January 2023 -- the highest number that has ever been recorded through the count and a 12% rise over the previous year. A primary cause of increasing homelessness is the extreme gap between wages and rents.

For additional information, and to download the reports, visit: http://www.nlihc.org/oor and https://www.jchs.harvard.edu/state-nations-housing-2024

Add new comment